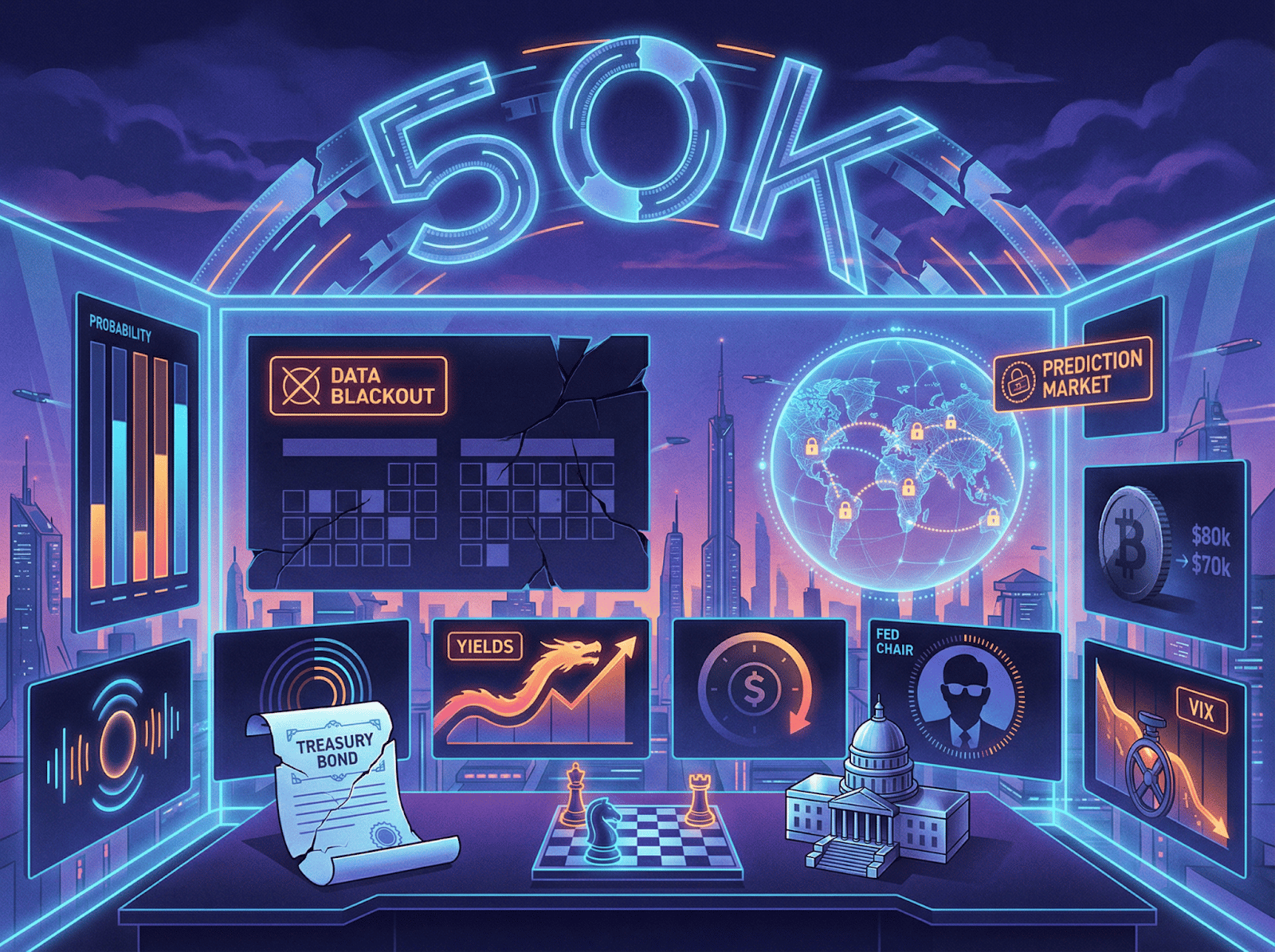

Dow crossed 50K without a jobs report. Kalshi holds Fed pause above 80% on $78M. China sells Treasuries while Polymarket prices a Trump visit by April at 84%.

THE DAILY PULSE

Futures wavered this morning after bond prices fell.

Chinese regulators urged banks to reduce US debt holdings, pushing the 10-year yield up to 4.23%.

The dollar slipped for a second straight day, extending a slide that has taken the index down 10% since inauguration.

Asia surged overnight. Japan's Nikkei climbed nearly 5% after an election supermajority.

The week ahead carries the data that last week didn't.

CPI lands Friday.

The Dow crossed a record milestone last week without either report. The S&P and Nasdaq both recovered around 2% after a punishing tech selloff.

The VIX collapsed over 18% in Friday's session alone. Risk appetite surged without new data to justify it.

Prediction markets already priced through the blackout.

Kalshi shows the Fed holding in March is at 83% on $5.5M in volume. Polymarket confirms at 84%.

CPI trades at 2.4% on Kalshi, a tick below the consensus 2.5% estimate.

Another shutdown by week's end sits at 73% on $1M in volume on Polymarket.

This week, delayed data meets a market that already priced the outcome. This is where consensus forms before the prints arrive.

PREMIER FEATURE

Former Illinois Farmboy Built a Weird A.I. System to Expose His Wife's Killer…

After his wife's untimely death, he used Artificial Intelligence to get sweet revenge...

But what happened next could change everything... while making a select few early investors very rich.

PREDICTIVE SIGNALS

THE LEAD SIGNAL

The Dow hit its milestone on the day payrolls should have landed.

The BLS delayed January employment data. CPI followed.

Two of the month's most important releases vanished from the calendar. Markets rallied anyway.

Prediction markets had already repriced.

Three weeks ago, the March hold traded near 17%. Kalshi now shows 83%. Polymarket shows 86%.

The repricing completed before the blackout began. Volume on Fed contracts surged while official data went dark.

Consensus expects around 60,000 jobs Wednesday and 4.4% unemployment. ADP showed just 22,000 private jobs added in January.

CPI consensus sits at 2.5%. Kalshi prices 2.4%. The gap between estimates and prediction market pricing is narrow. That's the signal.

When data confirms what contract volume already absorbed, traditional reaction compresses.

Wednesday may move less than the headline warrants. Not because the number doesn't matter. Because the repricing already happened.

Investor Signal: The repricing that matters already happened. $78M in Polymarket volume priced the Fed's March decision weeks before the data blackout. If Wednesday's print lands within the range prediction markets already absorbed, the muted reaction won't mean the data doesn't matter. It will mean the signal preceded the source.

THE ARCHITECTURE

The Warsh nomination landed ten days ago.

Markets absorbed it in a single session. Coverage framed it as settled. The headline moved on.

Prediction markets see a different timeline.

Kalshi shows Warsh confirmed before May at around 60%. Before June at just over 80%.

Powell's term expires in May.

Senator Tillis has publicly vowed to block any Fed nominee until a DOJ investigation resolves.

That creates a specific window of vulnerability that traditional coverage has not revisited.

Around 60% before May means prediction markets price a real chance of a leadership gap.

If Warsh is not seated before June, the Fed enters its most critical rate decisions without a confirmed chair.

Forward guidance enters a vacuum with no confirmed voice to deliver it.

Reaching 7,400 trades at around 60% on Kalshi. Above 7,600 drops below 50%. Above 7,800 falls under 30%.

Conviction thins fast above current levels.

A market that just crossed a milestone prices narrow confidence in sustaining it.

Investor Signal: Markets treated the nomination as a policy headline. Prediction markets priced it as a governance countdown. If confirmation stalls past May, the Fed's most important decisions of the year arrive without a confirmed chair. The question isn't who leads the Fed. It's whether your rate exposure assumes someone will.

FROM OUR PARTNERS

One Stock Poised to Soar

After 7 bear markets, 8 bull runs, and 44 years of firsthand experience, I’ve learned what separates short-term noise from real opportunity.

Now, as Editor in Chief at WallStreetZen, I’m applying a proven 4-step system to pinpoint stocks with the potential for triple-digit gains — and one just rose to the top of my list.

This week’s “Stock of the Week” has the setup I’ve seen before every major winner I’ve ever owned: strong fundamentals, powerful catalysts, and technical confirmation.

My new pick just went live — and early positioning is key.

THE CROSS-CURRENTS

Bond markets opened under pressure this morning.

Chinese regulators flagged concentration risk in US debt holdings.

The 10-year yield ticked up to 4.23%.

The dollar, already down 10% since inauguration, slipped further.

A new source of selling pressure surfaced before the week's data even arrived.

Polymarket shows a Trump visit to China by end of April above 80%, up 34 points, on over $1M in volume.

By end of March, just 3%. The timeline is specific.

Bond pressure that looks like deterioration may be leverage ahead of a diplomatic reset that hasn't been announced yet.

US and Iranian delegations concluded talks in Oman Friday. Both sides called them positive.

Polymarket prices a US strike by end of March above 40%, up 25 points. By June above 50%. Volume exceeds $200M.

Washington rolled out new sanctions the same day talks ended.

Diplomacy and military positioning advanced at the same time.

Bitcoin sank below $80K over the weekend. Now near $70K.

Kalshi shows above $100K year-end at 46%. Below $50K at 50%. Symmetric uncertainty.

MicroStrategy kept accumulating regardless. Weekly purchase above 1,000 BTC at 90% on Polymarket. Selling any by end of March at 1%.

Investor Signal: Chinese bond selling and a Trump visit priced above 80% by April tell two different stories through the same data. One reads as risk. The other reads as positioning. If your framework only accounts for the selling pressure, it isn't reflecting the diplomatic signal that $1M in volume already surfaced.

THE FORETELL LENS

What data vacuums reveal about pricing speed.

Most investors treat a delayed report as an inconvenience. The calendar shifts. Positioning waits. Nothing reprices until the number arrives.

Prediction markets don't pause.

When the BLS went dark, volume on Fed and inflation contracts continued.

Private payroll data, jobless claims, and contract flows replaced the missing prints.

Capital kept moving. Only the official timestamp stopped.

The amateur question: what will the jobs number be?

The professional question: does the number still move markets when prediction markets already priced the range weeks ago?

This week offers a natural experiment. Payrolls Wednesday. CPI Friday.

Prediction markets show the hold above 80% and inflation at 2.4%.

If both land within range, traditional reaction compresses. Not because the data doesn't matter. Because consensus formed without it.

Data vacuums don't create uncertainty. They reveal who was already positioned and who was waiting for permission.

Investor Signal: If equities barely react Wednesday, it won't mean the labor market doesn't matter. It will mean $78M in contract volume priced what the BLS will confirm. The gap between data publication and consensus formation has never been more visible.

FROM OUR PARTNERS

Pop Quiz: What's the 3rd Greatest Investment Since 2000?

Everyone knows NVIDIA is #1.

Some are shocked to learn Monster Energy is #2.

Even though it's averaged 29% returns every year since 2000... enough to turn $1,000 into $556,454.

It doesn't trade like a tech stock. And it was started as a private "trust fund" for the financial elite.

THE FINAL FRAME

This morning's Treasury pressure arrived before a single delayed print hit screens.

Chinese bond selling, a weakening dollar, and a second shutdown priced near 75% all converged on a market that spent last week celebrating without confirmation.

The prediction market map is specific.

Fed hold above 80%. Inflation at 2.4%. Iran strike by spring above 40%. Trump in China by April above 80%. Warsh confirmation by May a coin flip.

Each signal carries volume. Each preceded the traditional narrative.

Wednesday and Friday don't introduce new information. They introduce official timestamps for consensus that already formed.

The question isn't what the prints will show. It's how much positioning remains for markets that treated the data void as permission to rally.

The timing gap between prediction market consensus and traditional confirmation widened again this week.

Capital doesn't wait for the calendar. It prices through it.