Prediction markets closed every open question this week. Traditional assets are still debating.

THE DAILY PULSE

Every major question facing markets this week already has an answer.

The S&P slipped. The Dow rose on rotation. Tech sold off hard. Gold clawed back above $5,000 after last week's historic crash. The ten-year yield sat near 4.27%. VIX hovered around 16.

Traditional risk indicators say: uncertain.

Prediction markets say: resolved.

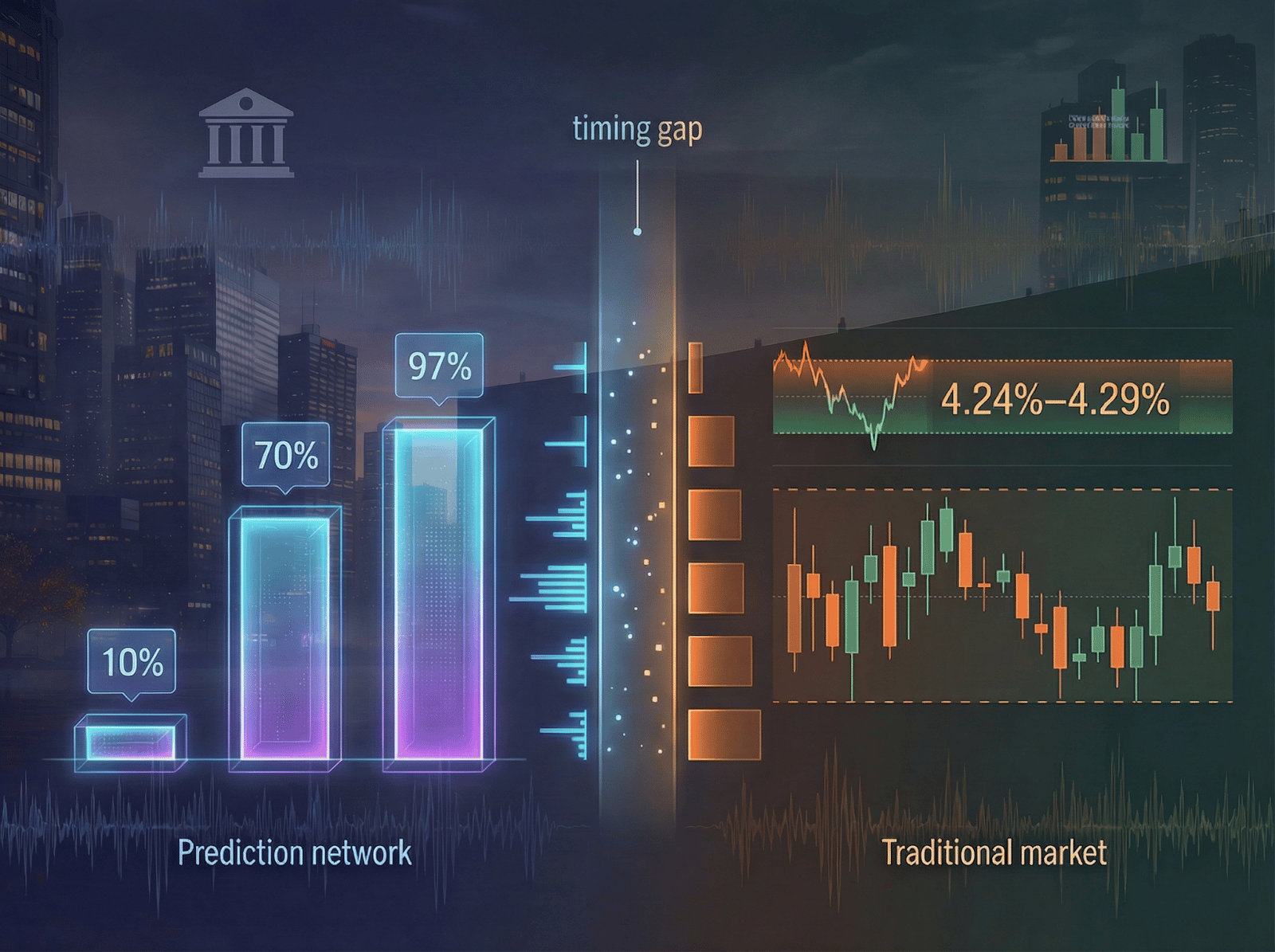

Polymarket showed over 95% confidence on the Fed Chair outcome. Kalshi anchored the Warsh appointment at the same level. NVIDIA priced at 70% to lead market cap. March rate cuts dead below 10% on both platforms.

The consensus is complete. Capital allocation hasn't started.

That gap between answers and positioning is the dominant signal across every asset class right now. This is where prediction markets lead the financial system.

PREMIER FEATURE

$1,000 into $556,454. Impossible?

I want to show you something that might make you upset.

For decades, the biggest banks in America have been using a secret account to collect an average of 29% per year — without ever telling the public.

Since 2000, this single account has turned $1,000 into over $556,454.

Not by picking stocks or timing the market. Just by parking money in an account that’s averaged 29% year after year.

The big banks knew about it. You didn’t.

That changes today.

PREDICTIVE SIGNALS

THE LEAD SIGNAL

Start with the bond market.

The ten-year yield traded in a narrow range near 4.27% all session. That's despite a hawkish Fed Chair nominee, a partial government shutdown that resolved in three days, and a weak ADP hiring report.

Yields stayed trapped in a tight band even as policy clarity arrived. That range is the tell.

Kalshi showed the Warsh appointment above 95% before the White House made it official. The nomination was pre-priced on prediction platforms by nearly a full week.

When markets sold off on the news, the reaction was real. Treasuries fell. The dollar rose. Gold collapsed. But the information wasn't new.

Prediction markets had already compressed to certainty.

Now rates sit in a range that knows the name but hasn't repriced the regime. Warsh favors a smaller Fed balance sheet. He's historically hawkish on inflation.

Senator Tillis has vowed to block the confirmation. But prediction markets already priced through that obstacle. Odds stayed pinned even after Tillis made his stance public.

The gap isn't about information access anymore. Everyone has the headlines.

The gap is about speed.

Committee-based capital moves slower than click-based probability. Risk committees need time to approve new frameworks. Mandate reviews take weeks even when the answer is obvious.

When the confirmation moves forward, bond markets won't discover anything new. They'll deploy.

Investor Signal

Duration positioning tied to the current Fed regime faces a shelf life measured in weeks, not quarters. Portfolios that wait for confirmation hearing headlines to adjust will reprice into a move that prediction markets already completed.

THE ARCHITECTURE

The equity story runs parallel.

Polymarket priced NVIDIA at 70% to finish February as the largest company by market cap. Apple trails at around 16%. The concentration winner was declared weeks ago.

But Nasdaq futures drifted sideways. The index fell over 1.5% on tech rotation, led by AMD's 17% drop on weak guidance.

Software stocks extended their brutal 2026 selloff. Value beat growth for a fifth straight session.

None of that goes against the prediction market signal. It confirms it.

The rotation is capital searching for where the answer already exists. Single-stock conviction on NVIDIA runs well ahead of index-level rebalancing.

Passive flows are still working through Q1 allocations. Momentum strategies that rely on relative strength are late to a signal prediction odds delivered weeks ago.

Alphabet's earnings showed the same pattern. Shares dropped on a $185 billion AI capex plan.

But NVIDIA and Broadcom rose in pre-market. The spending validates the very concentration prediction markets already priced.

Investor Signal

Concentration trades with prediction market confirmation at 70% or above are actionable before passive rebalancing flows arrive. Strategies waiting for relative strength breakouts in index data are pricing a signal that already resolved at the single-name level.

FROM OUR PARTNERS

Trump Backed One Massively Profitable American Company

There’s a new Trump story that could change everything — and it’s not about tariffs, foreign policy, or Congress.

It’s a story most people haven’t seen in the news, on cable TV, or or anywhere else.

Trump has made a public statement about one massively profitable American company — one most people have never heard of yet.

He actively went to bat for it and considers it crucial to the U.S. economy.

Some believe this could be one of the most undervalued stocks in the entire market, with the potential to make shareholders extremely wealthy.

THE CROSS-CURRENTS

Gemini AI model odds consolidated to over 95% as best model this week on Kalshi. Consensus preempted any official benchmark release by days.

The certainty compressed before third-party testing confirmed it. This is crowd intelligence front-running forward guidance across tech.

Amazon reports tonight. Polymarket shows OpenAI mentions at around 47% probability during the earnings call. Supply chain talk sits at 57%.

The narrative already rotated from logistics to AI before management spoke a word. Analysts still drafting notes about cloud margins are writing about yesterday's story.

The 2028 presidential race already trades with serious volume on Polymarket. J.D. Vance leads the Republican field near 49%. Gavin Newsom anchors the Democratic side around 32%.

Capital migrated to the distant horizon while the 2026 midterm picture stays foggy. When near-term visibility drops, money skips ahead to the next resolved outcome.

Fed rate cut odds for March collapsed below 10% across both platforms. The Warsh nomination killed the dovish scenario completely. VIX staying near 16 while rate cut expectations died tells you equity vol hasn't absorbed the policy shift.

That gap between rates certainty and vol levels signals that option positioning hasn't adjusted to a higher-for-longer regime under a new Chair.

Investor Signal

Assets tied to narratives that prediction markets already rotated past face repricing risk on the next catalyst. Positions aligned with where crowd conviction has consolidated, not where editorial coverage currently sits, carry a structural timing advantage.

THE FORETELL LENS

Amateur question: Why are prediction odds so extreme?

Professional question: Why hasn't capital followed?

The answer isn't about who knows what. Everyone saw the Warsh odds climb. Everyone watched NVIDIA's probability lock in. The shutdown odds were public. The rate cut collapse played out in real-time.

The answer is structural latency.

Prediction platforms aggregate conviction in hours. A single click updates the odds. No committee. No compliance review. No mandate approval.

Institutional capital moves on a different rail. Risk committees review positioning weekly. Rebalancing happens on quarterly cycles. New regime assessments, like pricing a Warsh-led Fed, require scenario work that takes weeks to complete.

That speed gap isn't closing. It's widening. Prediction systems keep getting faster. Institutional systems operate on the same cadence they did a decade ago.

The opportunity isn't knowing something others don't. It's acting while others still process what everyone already knows.

FROM OUR PARTNERS

An Investment Once Reserved for the Wealthy Just Opened Up

For decades, this corner of the market was largely inaccessible to everyday investors. Then a recent executive order quietly changed the rules. What was once off-limits is now available in a much more accessible way — and it’s already drawing attention.

THE FINAL FRAME

This week's prediction markets priced outcomes traditional assets haven't finished absorbing.

Warsh nomination at near-certainty. Tech concentration resolved with NVIDIA at 70%. Rate cuts dead for March. AI model leadership declared. The 2028 political map already trading.

Every catalyst ahead already has an answer on a prediction platform. Amazon earnings tonight. DHS funding cliff on February 13. Warsh confirmation hearings. When traditional markets react, they won't be discovering. They'll be confirming.

Information moves at platform speed. Capital moves at institution speed. The gap persists because these systems run on different rails entirely.

Forecasts compress. Flows follow. The gap persists.